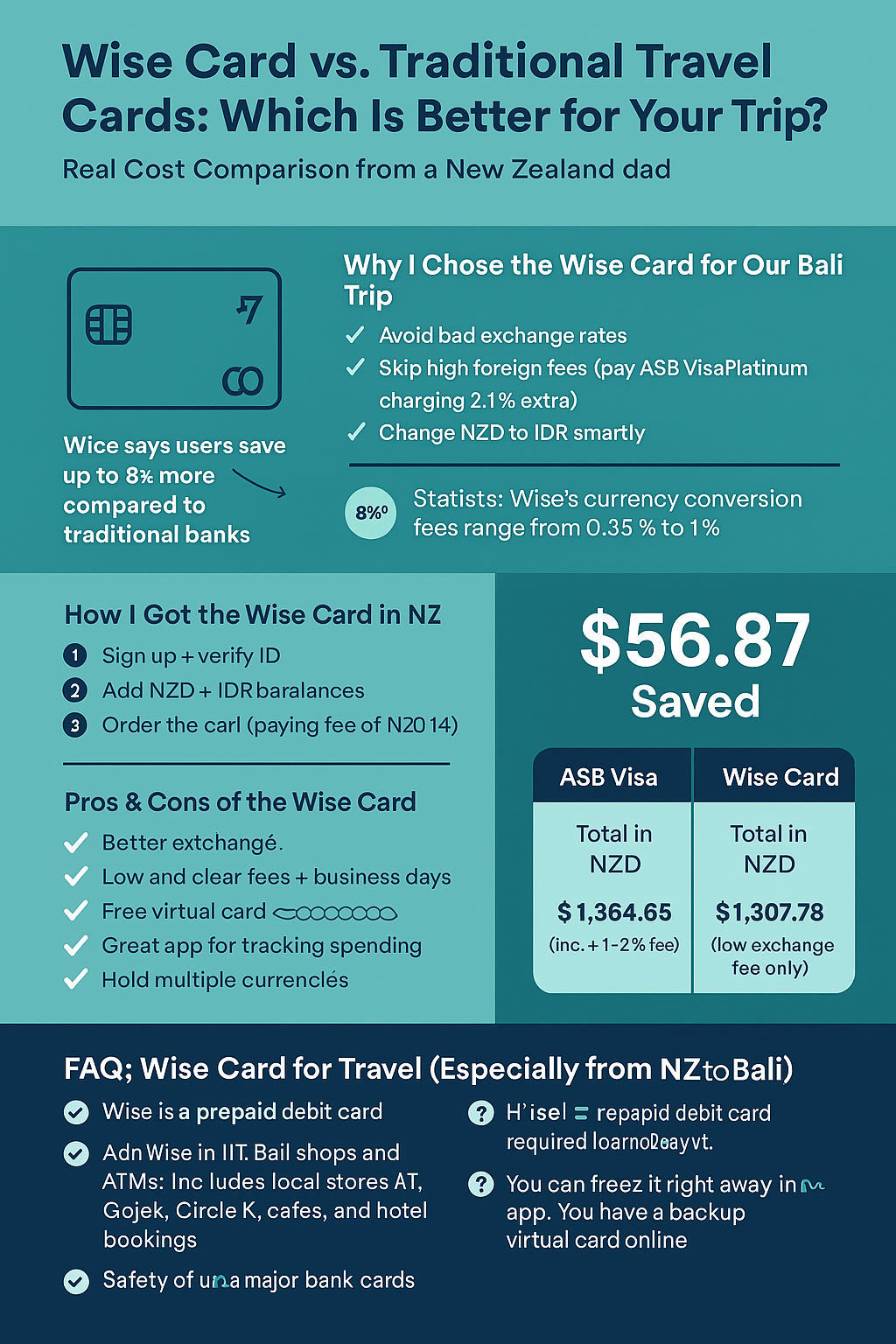

Wise Card vs. Traditional Travel Cards: Which Is Better for Your Trip?

Real Cost Comparison from a New Zealand Dad Traveling to Bali

Why I Chose the Wise Card for Our Bali Trip

Hey everyone,

As we gear up for our family holiday from Christchurch to Bali, I wanted to make smarter money choices—especially around exchange rates and overseas card fees. It’s so easy to lose money on poor rates or hidden charges when traveling.

This time, I went with the Wise card (formerly TransferWise), and even before we’ve left New Zealand, it’s already saved us money. Here’s how I set it up, what I’ve paid for so far, and a real-world cost comparison vs. my ASB Visa Platinum.

What Makes Wise a Smart Travel Card?

I wanted a travel card that:

- Avoids inflated exchange rates

- Charges fewer international transaction fees

- Lets me manage multiple currencies

- Is easy to use for online and in-person payments

Wise checked all the boxes. You get the mid-market exchange rate, ultra-low conversion fees, and you can hold multiple currencies like NZD and IDR in one app.

📊 Did you know? Wise users can save up to 8x more vs. traditional banks when spending or transferring internationally.

Setting Up My Wise Card in New Zealand

Here’s what the process looked like:

- Signed up via the Wise app

- Verified my ID

- Opened NZD & IDR balances

- Ordered the card (NZD 14 one-time fee)

- Got instant access to a virtual card while waiting for the physical one

🧠 Tip: If you’re planning a trip, give yourself 1–2 weeks for the card to arrive. But you can start spending online with the virtual card immediately.

First Use: Putting Wise to the Test

I used Wise for several key pre-trip and arrival expenses:

- Accommodation Bookings (IDR 10,164,949): Paid online using the virtual Wise card. No issues at all, and the rate was better than what my NZ bank offered. (See our full accommodation strategy in Bali Hotel Price Guide: How We Scored an Incredible 18-Night Stay Under $1080.)

- Tourist Visa & Levy (IDR 2,078,000 + IDR 618,000): Paid on arrival (and online where applicable) using the physical Wise card. Smooth transaction, no hidden fees.

The Real Savings: Wise vs. ASB Visa Platinum

Here’s where things got interesting. I did a side-by-side cost comparison using the official online calculators from:

- Visa (including ASB’s 2.1% foreign transaction fee)

- Wise (mid-market exchange + Wise fee)

Total Spending: IDR 12,860,949

(Includes accommodation, visa, and tax payments)

| Card | Total in NZD | Notes |

|---|---|---|

| ASB Visa | NZD 1,364.65 | Visa exchange rate + 2.1% ASB fee |

| Wise Card | NZD 1,307.78 | Mid-market rate + Wise fee |

💰 Total Saved with Wise: NZD 56.87

That’s enough to buy several meals in Bali or cover our Gojek rides for a few days. Just from using a better travel card.

Where I Plan to Use the Wise Card in Bali

We haven’t departed yet, but based on research and other travelers’ reports, here’s where I expect to use Wise easily:

✅ Local warungs and restaurants

✅ Beach cafes

✅ Circle K and Indomaret stores

✅ BCA and Mandiri ATMs

✅ Gojek rides and food delivery

✅ Hotel and tour bookings (online or in-person)

💳 If all goes to plan, using Wise should feel just like tapping my NZ debit card—but with less regret when checking the exchange rate.

Pros & Cons of Using Wise for Travel

✅ What I Love:

- Great exchange rate (mid-market)

- Low conversion fees (around 0.37%)

- Virtual + physical card combo

- Works with Apple/Google Pay

- Supports 40+ currencies

- Instant spending alerts via app

⚠️ What to Watch For:

- Prepaid: you must top it up in advance

- NZD → IDR transfer takes 1–2 business days

- Some ATMs still charge local fees

- $14 fee to order the physical card

Bonus Tip: Exchange Currency When Rates Are Best

One of Wise’s strengths is that you can hold your funds in NZD and convert to IDR only when the rate is good. No rush, no pressure. Here’s my approach:

- Load NZD into Wise

- Watch IDR rates (the app helps)

- Convert when rates peak

- Spend later with your IDR balance

That kind of control just isn’t possible with a typical travel card or bank credit card.

Is the Wise Card Worth It? My Verdict (So Far)

Even before stepping on the plane, I’m already NZD 56.87 ahead just by choosing a better payment method. That’s real money, not hypothetical savings.

We’ll carry a small amount of cash and keep our ASB Visa for backup, but Wise is my main card for this trip.

After the trip, I’ll report back on exactly how it performed—from ATMs to food delivery to mini-marts. (You can also check our full pre-trip cost breakdown in Travel Budget Bali: Our 18-Night Family Itinerary Under $5,000.)

💡 FAQ: Wise Card for Bali Travel

Q1. Can I use Wise at Bali shops and ATMs?

That’s the plan! I’ll confirm in my post-trip update, but other travelers report no issues.

Q2. Is the Wise card a credit card?

Nope—it’s a prepaid debit card. You load and spend your money.

Q3. Is it safe?

Yes. Wise is licensed and secure. You can freeze your card instantly via the app.

Q4. How long does a top-up from NZ take?

Usually 1–2 business days from ASB to Wise.

Q5. Do I need both the virtual and physical card?

The virtual card is great for online bookings and tap-to-pay. The physical card works at ATMs and most shops.

Want to Try Wise? Here’s My Referral Link

Here’s my personal Wise invite link:

👉 https://wise.com/invite/ihpn/guwanj2

🎁 Perks:

- Get your first transfer (up to $900 NZD) fee-free

- Or get your first card without the $14 fee

What’s Next?

After our Bali trip, I’ll share a detailed follow-up:

- Where the Wise card worked (and didn’t)

- What the final costs looked like

- How much cash we actually needed

- Family tips for Bali travel on a budget

Thanks for following our journey here at The Herianian—if you’ve tried Wise abroad, I’d love to hear your experience in the comments!

5 Comments