My Wise Card Limit Scare: Why Custom Spending Controls Are a Traveler’s Best Friend

A Scary Moment at an ATM in Gili

I was in Gili Trawangan, Indonesia, and I needed some cash. I used my Wise card at a BNI ATM. The first withdrawal—2,000,000 rupiah—worked. But when I tried to take out another 1,450,000 rupiah, the machine gave my card back without any money.

I panicked. Was my card blocked? Was there a problem with the machine?

I called the number on the ATM and tried to talk to someone. The voice messages were in Indonesian, and it was hard to understand. When I finally reached a person, they just told me to call my card provider.

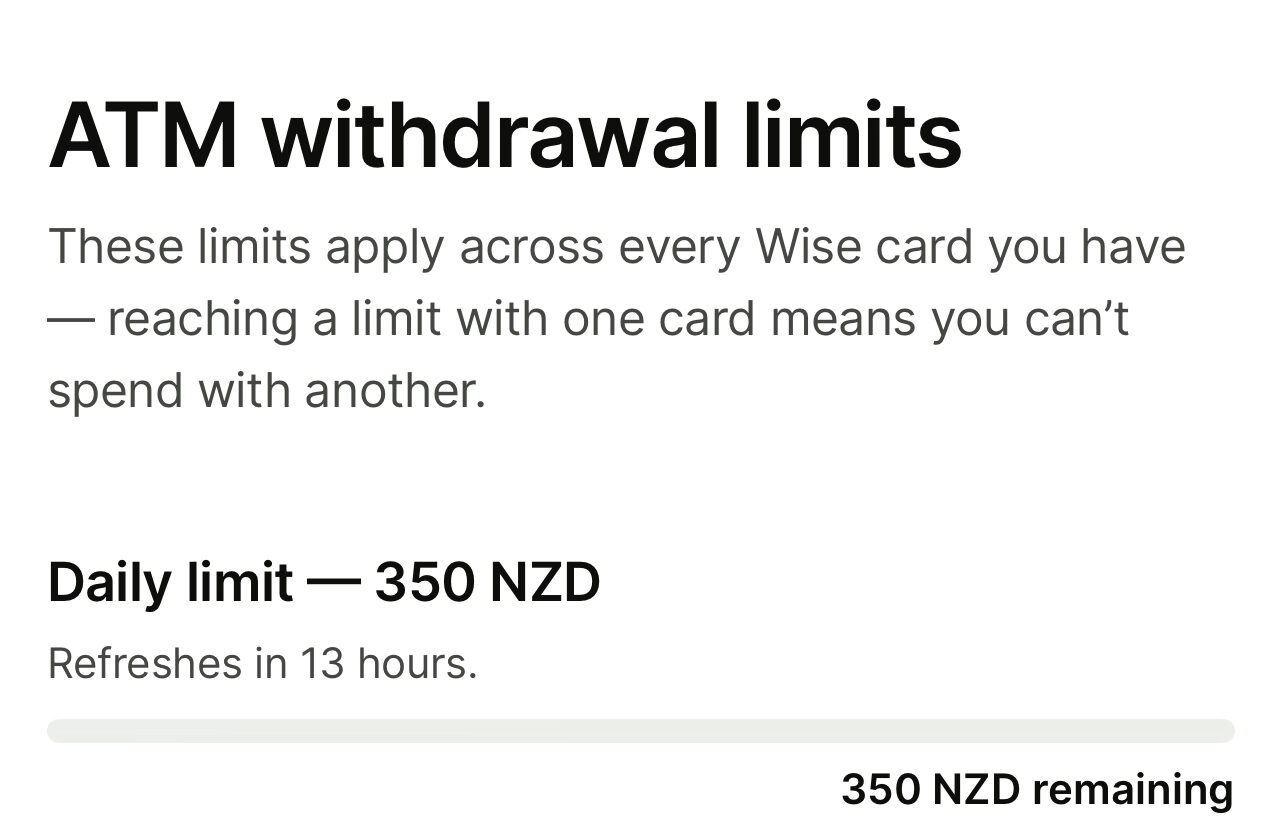

So I opened the Wise app. Right away, I saw what happened. The second transaction was declined. I had hit my ATM withdrawal limit.

Then I remembered—I had set a NZD $350 monthly limit on ATM withdrawals. I did this to avoid extra fees. And it worked just like it should.

Even though I forgot about the limit, it saved me money. I could still use the card to pay for things. Only cash withdrawals were blocked.

What Is a Wise Card?

The Wise card is a travel-friendly debit card from Wise (formerly TransferWise). You can hold many currencies in one account, and the card automatically uses the best exchange rate when you pay.

It works in most countries, and you can use the Wise app to control everything—spending, limits, security, and more.

Stat #1: Over 16 million people use Wise globally, and it’s available in more than 160 countries.

(Source: Wise Company Overview)

Two Types of Limits You Can Set

One of the best features of the Wise travel card is that you can set limits. You can control how much you withdraw from ATMs and how much you spend on purchases.

1. ATM Withdrawal Limit

This controls how much cash you can take out. You can set a daily or monthly limit, anywhere from 0 to NZD $7,000.

- I had mine set to NZD $350 per month.

- It applies to all your Wise cards.

- It helps reduce ATM fees and keeps your money safe if the card is lost.

2. Spending Limit

This controls how much you can spend using the card for purchases (not cash withdrawals). You can set a daily or monthly amount, from 0 to NZD $52,500.

- I kept this at the maximum to allow flexibility.

- It also applies across all your Wise cards.

- Useful for booking hotels, paying for tours, or emergency spending.

Why These Limits Matter for Travelers

When you’re traveling, your card is your lifeline. Losing access can ruin a trip. Setting limits helps you stay safe and in control.

Benefits of the ATM Limit

- Avoid high ATM fees (especially in tourist areas).

- Protect your money if your card is stolen or copied.

- You won’t lose everything—even if someone gets your PIN.

Benefits of the Spending Limit

- Set a daily budget to control spending.

- Lower your risk if your card details are stolen.

- Raise it when needed (you can do this in seconds in the app).

Real-Life Lesson: My Experience in Gili

At first, I thought something had gone wrong. But in the end, I was thankful. The Wise card worked just the way I set it up. It blocked extra withdrawals to avoid fees and kept the rest of my money safe.

I was still able to pay for food, transport, and other things using the card.

This made me realize: the Wise card isn’t just a tool. It’s a safety net when you’re far from home.

Stat #2: Wise claims users save up to 6x compared to traditional banks when spending abroad.

(Source: Wise Official Site)

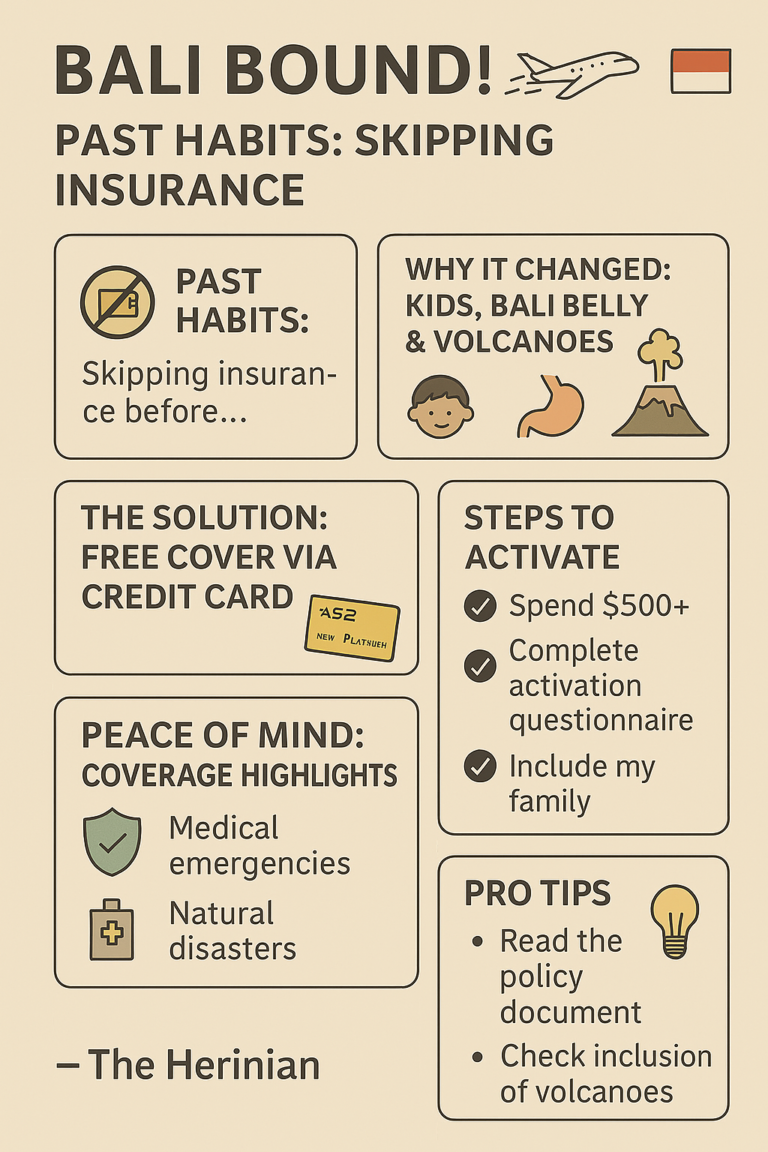

Why I Use the Wise Card for Family Trips

As a dad traveling with kids, I need things to go smoothly. Here’s why I love my Wise travel card:

- I can hold multiple currencies in one account.

- I get instant notifications for every purchase.

- I can freeze or unfreeze the card in seconds.

- The exchange rate is fair, not inflated like many bank cards.

- I can share the account with my partner using another card.

If you’re not sure how it compares to other travel cards, check out my detailed breakdown:

👉 Wise Card vs. Traditional Travel Cards: Which Is Better for Your Trip?

How to Avoid Common Mistakes

Here are tips for using your Wise debit card wisely:

- Set your limits before traveling.

- Turn on notifications in the app.

- Don’t rely only on ATMs—carry a little cash too.

- Freeze your card right away if it’s lost or stolen.

- Check daily usage when you’re in countries with card restrictions.

Final Thoughts: A Smart Card That Has Your Back

When I first hit my ATM limit, I was stressed. But now I see that moment as a win. The Wise card protected me from extra charges. I didn’t need to call a bank or wait for a new card. Everything was in my control, right in the app.

If you travel often—or even just once a year—this card is worth having. It gives you safety, savings, and peace of mind.

FAQ: Wise Card for Travelers

Q1: Can I use the Wise card in any country?

Yes, the Wise card works in over 160 countries. Just make sure the country supports MasterCard or Visa payments.

Q2: What happens if I lose my card while traveling?

You can freeze the card instantly in the app. You can also order a replacement card to your location.

Q3: Is Wise card better than using my local bank card abroad?

Most likely, yes. Wise uses the real exchange rate with low fees, while banks often charge 3–5% in hidden fees.

(Compare here: Wise vs. Traditional Travel Cards)

Q4: Do I need to preload money onto the Wise card?

Yes, you need to top up your Wise account before using the card. You can add money in your local currency and convert it when needed.