Family Travel Insurance for Bali – How We Got It Free!

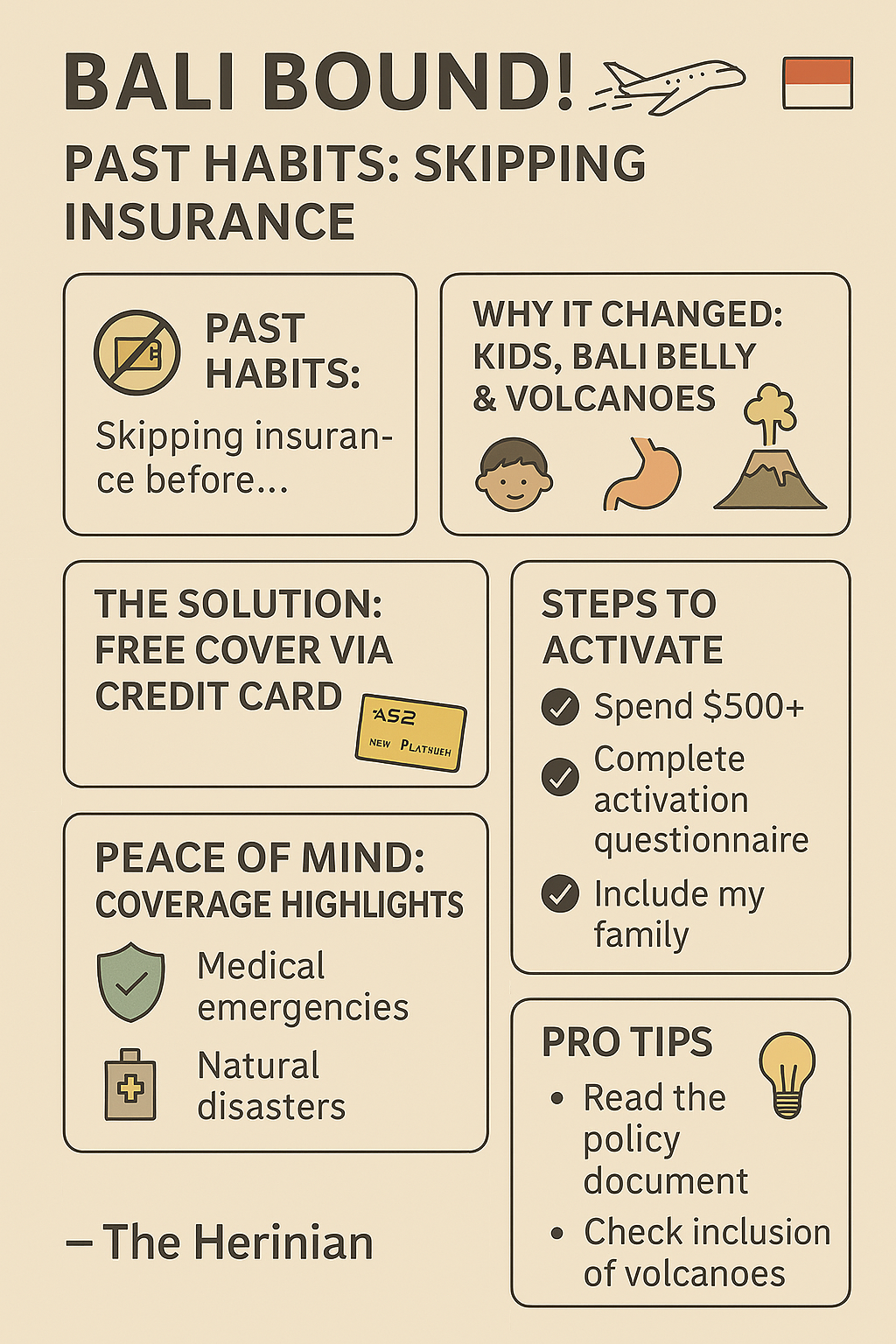

Bali Bound! Why This Dad Finally Got Travel Insurance (and Scored it for FREE!)

Hey fellow travellers!

Family travel insurance isn’t something I used to think about—but planning our family trip to BALI changed everything. Have you ever asked yourself, “Do I really need travel insurance for a family holiday?” Let me tell you why the answer is a big YES.

The Herinian family is buzzing with excitement – we’re heading to BALI! Visions of sandy toes, temple explorations, yummy food, and precious family time are dancing in our heads. Planning is underway, but this trip feels different. Why? Because it’s not just me anymore. It’s me, my wife, and our two kids. And that changes everything, especially how I think about planning.

(Image Suggestion: A picture of your family, maybe looking at a map or globe, OR the ASB card with passport/Bali guide)

Confession Time: My Past Travel Insurance Habits (or Lack Thereof!)

Okay, honesty hour. I’ve never actually bought travel insurance before. 😬 When I travelled solo or just as a couple, I guess I rolled the dice, figuring I’d handle whatever came up. It seemed like an extra expense, maybe even unnecessary.

But things change. Travelling as a father of two puts a whole new perspective on things. Suddenly, “winging it” doesn’t feel adventurous; it feels potentially irresponsible. What if one of the kids gets sick? What if we have an accident? What if our trip gets massively disrupted?

What Triggered the Change? (Hello, Bali Belly & Volcanoes!)

Three things really brought the importance of family travel insurance home for me recently, especially thinking about Bali:

- The Infamous “Bali Belly”: You hear the stories. While often mild, a nasty bout could mean dehydration and needing a clinic visit or even hospitalisation for IV fluids, especially worrying with little ones. Medical help isn’t free.

- Unexpected Medical Costs: Beyond tummy troubles, accidents happen. A scooter tumble, a fall, a sudden infection – these can require serious medical care. I learned that tourist medical bills in Bali can skyrocket fast, potentially hitting thousands or tens of thousands for hospital stays or emergency flights home. Your NZ health cover? It likely won’t help you there.

- Recent Flight Chaos (Volcanoes!): Seeing news about volcanic eruptions near Bali grounding flights and leaving travellers stranded was a major wake-up call. Imagine being stuck with two kids, paying for extra nights, food, and desperately trying to rebook flights during chaos. That’s a scenario I absolutely needed a safety net for.

Suddenly, travel insurance wasn’t an optional extra; it felt like a non-negotiable part of responsible family travel planning.

The Relief: Finding FREE Family Travel Insurance!

So, needing insurance but also being budget-conscious (family life!), I was absolutely thrilled to remember a major perk of my ASB Visa Platinum Rewards credit card: complimentary overseas travel insurance!

I’d recently received an email about policy updates, which jogged my memory. This little piece of plastic could potentially cover our whole family for those exact scenarios I was now worried about.

How We’re Activating This “Free” Insurance for Bali:

It requires a few simple steps, not just having the card:

- Eligibility: Have an eligible ASB Visa Platinum card. (Check!)

- Spend $500+ on Prepaid Travel Using the Card: This is where intention came in. I only paid for our Gili Islands accommodation with my ASB Platinum Visa – not because it was the cheapest option (my Wise card usually has better rates and lower foreign transaction fees) – but specifically to meet the $500 minimum required to activate the complimentary family travel insurance. If you’re curious why I use Wise most of the time, here’s a breakdown of my card habits: Wise Card vs Traditional Cards – Which One is Better?

- Complete the Activation Questionnaire: After meeting the $500 spend, I went online to the ASB Travel Insurance portal and filled out their activation form. It’s a super important step – don’t skip it!

- Family Included? Yes! This is the best part. The policy covers me (the cardholder), my spouse, and our dependent children traveling with us for the whole trip (provided we meet the T&Cs).

- Duration & Age: It covers trips up to 90 days. Standard cover is for travellers up to 75 years of age.

Important Things I’m Paying Attention To (Especially Re: Volcanoes!)

Being newly insurance-aware (and a concerned dad!), I made sure to look closer:

- READ THE POLICY DOCUMENT: No skipping this! I needed to understand exactly what’s covered (medical limits, cancellation specifics, delay benefits), what’s excluded, and what hoops we might need to jump through if we claim. You can find ASB’s policy here: ASB Visa Platinum Rewards Travel Insurance Policy (source)

- Check Natural Disaster Cover (Volcanoes!): I specifically scanned the sections on trip cancellation and delay for natural disasters. Generally, policies can cover unforeseen events like eruptions, but only if the policy was active before it became a known event. I checked:

- Does it mention volcanic ash clouds? (Yes, it seems to be covered under certain conditions.)

- What are the delay requirements (e.g., 6+ hours)?

- What are the financial limits for extra accommodation/food per day? Knowing this upfront is key.

- Confirm Activation: Use their online tool before the trip.

- Emergency Number Saved: Already saved in my phone contacts!

Why Family Travel Insurance Now Feels Like a Must

Honestly, knowing we have this insurance sorted through our ASB card – just by using it for expenses we already had – provides incredible peace of mind. It addresses those specific worries about Bali Belly turning serious, unexpected accidents, and even the chaos of volcanic ash clouds. It means I can focus more on soaking up the Bali experience with my family, knowing we have a safety net.

Traveling with kids is magical – but unpredictable. Family travel insurance isn’t about being paranoid; it’s about being prepared. From emergency medical cover abroad to protection from delays and cancellations, it’s one of the best things we can pack – even if it’s invisible.

So, if you’re like me and maybe haven’t prioritised travel insurance before, especially now that you’re travelling with family, check your credit card benefits! You might have valuable cover waiting. Just be sure to understand how to activate it and exactly what it covers by reading that policy document.

Right, back to dreaming about Bali adventures with my favourite little explorers! Being prepared makes the journey that much sweeter.

Useful Stats for the Cautious Family Traveller

- According to Canstar NZ, over 70% of Kiwis who travelled overseas in 2023 experienced some form of delay, cancellation, or lost luggage.

- The Ministry of Foreign Affairs and Trade (MFAT) strongly recommends comprehensive travel insurance, especially when travelling with dependents or to destinations with natural risks.

Frequently Asked Questions about Family Travel Insurance

Is complimentary credit card travel insurance enough for a family?

It can be! Many premium cards like the ASB Visa Platinum include cover for your spouse and dependent children. But always read the fine print—especially limits and exclusions.

What if I forget to activate the insurance?

You’re not covered. Simply owning the card isn’t enough. You need to meet the spend requirement and complete the activation form online before departure.

Are pre-existing medical conditions covered?

Usually not, unless you apply for and receive written approval from the insurance provider. Always disclose any conditions during activation.

Can I extend the coverage if our trip is longer than 90 days?

In most cases, no. Complimentary insurance is capped at a certain duration. You might need a separate policy for extended travel.

Does insurance cover natural disasters like volcanic eruptions?

Yes—if you activated the policy before the event became publicly known. Always check the specific clauses and stay updated on travel advisories.

Disclaimer: I’m sharing my personal experience and understanding based on my ASB Visa Platinum card and information from ASB/general research. This isn’t financial or insurance advice. Information about risks is for awareness. Always check the latest policy documents directly with your provider to ensure cover meets your family’s specific needs before travelling. Verify all coverage details, especially for natural disasters.